All Categories

Featured

Table of Contents

- – High-Performance Foreclosure Overages List Gui...

- – Top Bob Diamond Tax Overages Blueprint Trainin...

- – All-In-One Tax Foreclosure Overages System Ta...

- – Innovative Real Estate Overages Blueprint Tax...

- – Elite Tax Overages Business Opportunities Pr...

- – Sought-After Tax Overages Business Strategy ...

All cases should be filed not behind one year from the day the tax deed is recorded or else the case can not be taken into consideration. There are no exemptions to the 1 year period to sue. No award resolutions will be made up until after the one year declaring period has actually ended.

Any type of action or proceeding to challenge the honor decision must be begun within 90 days after the date of the decision. If unclaimed excess proceeds continue to be at the end of one year after the recordation date of tax obligation action to buyer, the tax obligation collector may subtract the cost of maintaining the redemption and tax-defaulted property files that was not recouped and/or down payment the excess unclaimed earnings right into the region basic fund.

Excess funds are not distributed to 3rd parties by this office unless that 3rd party is an accredited attorney for the claimant. Unclaimed Tax Sale Overages. Attorneys need to offer their state bar number as confirmation. The Tax obligation Commissioner's Office does not acknowledge a lawful partnership of "representation" by an asset recover company, neither by an individual that has been approved Power of Lawyer

Claims by lien owners should consist of a current payback statement. Rights to excess funds are regulated and developed by state regulation which establishes the concern of liens and which ones obtain paid. All insurance claims and excess funds of $100,000 and over will immediately be interplead with the remarkable court most of the times.

High-Performance Foreclosure Overages List Guide Overages List By County

As a result of natural changes in company, we will certainly offset your excess to a scarcity that drops the month prior to or after the scarcity during an audit. Any kind of scarcity not covered by an overage will certainly cause additional tax when an audit of your documents is completed.

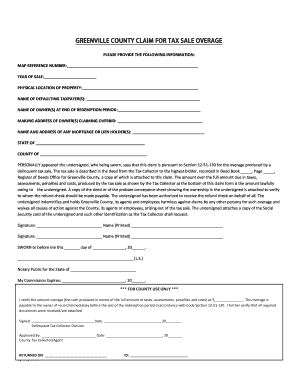

The owner of record immediately prior to the end of redemption period should sign the contract and release form. If there are multiple proprietors, all should authorize. Send to the Delinquent Tax Collection agency Workplace this finished type (Contract and Release Kind) with the adhering to accessories: Action or Probate conveyance by which Plaintiff(s) Acquired Residential property.

Vehicle driver Permit or various other Image I.D. of ALL Claimant(s). The Delinquent Tax obligation Collection agency will verify the quantity of the overage and validate the identification of the claimant(s). If there is any kind of concern about the veracity of the claimant(s), they will certainly be called for to obtain a court order to get the excess.

Top Bob Diamond Tax Overages Blueprint Training Real Estate Overage Recovery

These sums are payable ninety (90) days after implementation of the deed unless a judicial activity is instituted throughout that time by an additional plaintiff. If neither asserted neither designated within five years of the date of public auction tax sale, the overage will escheat to the basic fund of the regulating body.

If you have any type of questions, please call Delinquent Tax at 803-245-3009. The Overdue Tax Enthusiast makes every initiative to supply the most accurate details possible.

All-In-One Tax Foreclosure Overages System Tax Overage Recovery Strategies

If numerous people are noted as the owners, after that the check will be detailed in all of the owners' names, or released to an estate, if the estate was the last owner of document.

Locate out info regarding the York County Council Full our on the internet FOIA application. Objective and Vision Declaration of York Region Pennies for Development is the name of the York Area Funding Projects Sales and Use Tax Obligation Programs. Gain an understanding of the strategies for York County from the Region Council and Region Manager.

There might emerge numerous and contradictory claims for these funds. Please be aware that in the occasion of clashing cases, the funds might be placed in Superior Court of Chatham Region by means of an interpleader action so that a court might determine that the rightful individual to obtain these funds may be.

Once funds have been placed right into Superior Court, the plaintiff will need to speak to Superior Court at ( 912) 652-7200 with any type of inquiries. The Tax obligation Commissioner's Office will not have details on the funds or their disbursement. Excess funds are subject to priority case by the mortgagee or safety and security interest owner.

Innovative Real Estate Overages Blueprint Tax Overages

To get factor to consider, all insurance claims must consist of the following: that has been finished and signed by the potential complaintant of the funds. Image identification Reason and evidence of possession of the excess funds It is the plan of the Tax obligation Commissioner's Office that all checks are made payable to the owner, safety deed holder or lien owner of the funds just, not to a third celebration.

Excess earnings from the sale of tax-defaulted residential property is defined as any kind of amount that mores than the minimum proposal cost. Events having an ownership or lien owner passion in the home at the time the residential or commercial property is cost tax obligation sale have a right to sue for any kind of excess profits that stay.

Elite Tax Overages Business Opportunities Program Bob Diamond Tax Sale Overages

Adhering to a tax obligation sale, any type of overage of funds, understood as 'excess funds,' is put in a different account. Case forms need to be returned to the tax commissioner's office completed in their entirety and in an unaltered state.

Claim kinds are declined from 3rd parties, other than in the situation of a lawyer that is legitimately representing the complaintant in the issue. The tax obligation commissioner's workplace does not recognize a legal connection of "representation" by a property recovery firm, nor by a person that has been granted Power of Attorney.

If even more than one case is gotten, a court may identify who will certainly receive the funds. Any kind of essential lawful evaluation of excess funds cases will affect the timing of the repayment of those funds. Repayment of excess funds will certainly be made and sent just to the document owner of the home, or to other parties having a lien holder passion at the time of the tax obligation sale.

Sought-After Tax Overages Business Strategy Unclaimed Tax Overages

Tax liens and tax obligation deeds often cost higher than the area's asking cost at public auctions. Furthermore, the majority of states have laws influencing proposals that surpass the opening quote. Settlements above the area's criteria are called tax sale excess and can be profitable investments. The information on excess can create problems if you aren't aware of them.

Table of Contents

- – High-Performance Foreclosure Overages List Gui...

- – Top Bob Diamond Tax Overages Blueprint Trainin...

- – All-In-One Tax Foreclosure Overages System Ta...

- – Innovative Real Estate Overages Blueprint Tax...

- – Elite Tax Overages Business Opportunities Pr...

- – Sought-After Tax Overages Business Strategy ...

Latest Posts

Tax Lien Investing Risks

Otc Tax Liens

How To Invest In Tax Liens

More

Latest Posts

Tax Lien Investing Risks

Otc Tax Liens

How To Invest In Tax Liens