All Categories

Featured

Table of Contents

These would certify as certified financiers under various requirements in the definition. The SEC has a set of questions it sends on a regular basis to determine the status yet I was not able to discover if these outcomes are published publicly. Quotes of the number of financiers who are accredited are generally produced by market research study projects or companies.

There is no restriction to the amount of dollars a capitalist can buy a Guideline D 506(c) offering. But there can indeed be limitations imposed willingly by the financial investment itself. This is usually to stop any solitary financier holding a regulating passion in the investment. Law D refers to Policy D of the Stocks Act of 1933 guideline that manages private funds.

Regulation 506(c) enables firms to carry out general solicitation for their financial investments supplied that all capitalists are certified capitalists at the time they pay into the investment. You can show your certified financier condition to the business providing you protections by offering a letter from your accountant, tax declaring documents, pay stubs, financial institution declarations, monetary statements, or any type of various other certification that shows you satisfy the necessary needs.

It is the obligation of the investment company that is providing you the safeties to identify your condition. They will certainly let you recognize what they require, to confirm adequately to themselves that you meet the requirements. Approved financiers have accessibility to possibly higher-yield investments however this does not immediately assure them a higher return.

Elite Private Placements For Accredited Investors

These financial investment kinds are taken into consideration high-risk, however HNWIs spend in them due to the fact that they do provide such constant gains. The returns from alternative financial investments are commonly much higher than for Exchange Traded Funds (ETFs) or Mutual Funds.

These returns are a few of the most effective in the industry. Accredited financiers have accessibility to a much broader variety of financial investment opportunities to generate income. These consist of realty syndications, hedge funds, personal equity real estate, and much more. Different financial investments offer a few of one of the most flexible kinds of investment methods around due to the fact that they do not require to adhere to guidelines so strictly.

Any person who does not satisfy the accredited capitalist criteria is thought about an unaccredited investor, or a non-accredited financier. That implies the person does not have either the total assets or the called for understanding to be exposed to the prospective threat readily available in high-yield financial investments. The crowdfunding model is a wonderful possibility for unaccredited investors due to the fact that it has actually produced numerous possibilities for people who don't have actually the funding needed to buy larger tasks.

Esteemed Private Placements For Accredited Investors

A Certified Buyer is somebody with at the very least $5 million worth of financial investments. Every qualified buyer is instantly likewise a certified investor yet every accredited capitalist is not necessarily a qualified buyer. Additionally, an accredited capitalist may have a web worth of over $5 million yet not have all of it connected up in investments (accredited investor property investment deals).

Financial Planning and Analysis (FP&A) is the method of planning, budgeting, and analyzing a specific or service's monetary standing to determine the most effective feasible method onward for their riches. FP&A is a particularly crucial activity for recognized capitalists to make sure that their riches does not devalue as an outcome of rising cost of living.

Not all advanced investors are approved. An advanced capitalist is simply somebody who has shown considerable understanding of financial and service events. Sophisticated financiers in some cases direct those that are recognized. The levels of accreditation for financiers are: Non-accreditedSophisticated investorsAccreditedQualifies investorsEach level has the right to spend in gradually riskier projects. In particular offerings, advanced investors are permitted to participate, such as in 506(b) offerings, nonetheless, Wealthward Resources deals only in 506(c) offerings so all our investors require to be recognized.

Accredited Investor Property Investment Deals

Some investment chances can be greatly regulated to secure capitalists and the providers of safety and securities. The U.S. Securities and Exchange Commission (SEC) does not permit all financiers to make every financial investment. Particular investments are restricted only to certified capitalists, which are people or entities that meet a list of strict certifications.

Understanding just how to end up being a certified capitalist can aid you identify whether you certify. The interpretation of a recognized capitalist is a lawful entity or an individual that is legitimately permitted to purchase investments that are not registered with the SEC. The SEC approved investor interpretation hinges on Regulation 501 of Guideline D of the Stocks Act of 1933.

Trusted Top Investment Platforms For Accredited Investors

Offerings registered with the SEC has to publicly divulge details to financiers and satisfy particular requirements from the SEC for securing investments. These investment opportunities include publicly traded bonds, supplies, common funds, and openly traded property investment company (REITs). Certified financiers need to have the economic knowledge and experience to invest in offerings that don't supply these defenses.

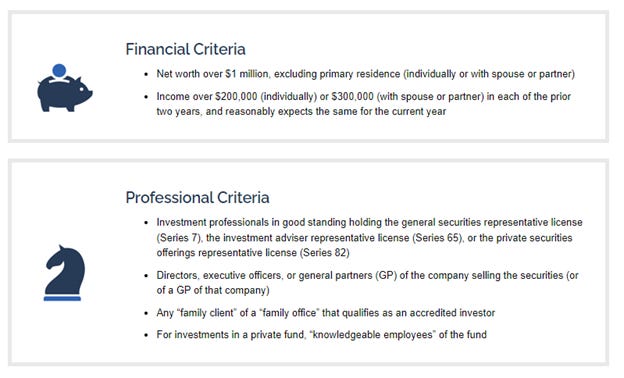

The needs for qualifying as a certified financier are in location to make sure these investors have the wherewithal to handle their funds and shield themselves from loss. The term approved investor is additionally used to describe investors that have the economic ability to absorb losses. The SEC's requirements for recognized capitalists are different for private and institutional investors.

The financier must reasonably anticipate to keep the exact same income level in the existing year. Their internet well worth can not consist of the value of their main house.

Best Accredited Investor Opportunities

Guideline 501 furthermore offers requirements for companies, organizations, trust funds, and various other entities to certify as recognized capitalists. An entity can certify as a recognized investor when it satisfies one of the following criteria: The company or personal service certifies as an approved financier when it has greater than $5 million in possessions.

If all of the entity's owners are accredited financiers, the entity can operate as a certified financier. The full list of requirements likewise consists of details firm kinds regardless of total assets or financial investments, consisting of: BanksInsurance companiesInvestment companiesCertain staff member benefit plansBusiness development companies The certified financier interpretation ensures financiers have the funds and experience to sensibly shield themselves from loss.

Business can sell safeties exclusively within one state without government enrollment. They must be included in the state and might still require to fulfill state needs. Business can market safety and securities to non-accredited financiers utilizing crowdfunding systems under the JOBS Act. They do not need to sign up, business still must satisfy disclosure needs, and the quantity they can increase is limited.

The certified financier group safeguards investors. They also want to protect much less knowledgeable financiers who don't have the understanding to understand an investment's dangers or the padding to take in losses.

Table of Contents

Latest Posts

Tax Lien Investing Risks

Otc Tax Liens

How To Invest In Tax Liens

More

Latest Posts

Tax Lien Investing Risks

Otc Tax Liens

How To Invest In Tax Liens