All Categories

Featured

Table of Contents

- – Strategic Exclusive Deals For Accredited Inves...

- – World-Class Passive Income For Accredited Inve...

- – Comprehensive Exclusive Deals For Accredited ...

- – Efficient Accredited Investor Crowdfunding Op...

- – Accredited Investor Real Estate Deals

- – World-Class Venture Capital For Accredited I...

- – Renowned Accredited Investor Syndication Deals

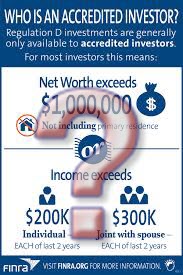

The guidelines for accredited capitalists vary among territories. In the U.S, the interpretation of a certified financier is put forth by the SEC in Rule 501 of Regulation D. To be a recognized investor, an individual should have an annual revenue going beyond $200,000 ($300,000 for joint revenue) for the last two years with the assumption of making the very same or a greater income in the current year.

This quantity can not consist of a main home., executive policemans, or supervisors of a business that is providing non listed securities.

Strategic Exclusive Deals For Accredited Investors for Financial Growth

Likewise, if an entity contains equity owners that are certified capitalists, the entity itself is an accredited capitalist. Nevertheless, an organization can not be developed with the single function of acquiring certain safeties - exclusive investment platforms for accredited investors. A person can qualify as an accredited investor by demonstrating enough education or job experience in the monetary market

Individuals that wish to be accredited financiers don't relate to the SEC for the designation. Instead, it is the duty of the company using an exclusive placement to make sure that every one of those approached are accredited investors. People or parties that want to be certified financiers can come close to the company of the non listed safeties.

As an example, expect there is an individual whose income was $150,000 for the last 3 years. They reported a primary residence worth of $1 million (with a home loan of $200,000), an automobile worth $100,000 (with an outstanding financing of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

This person's web well worth is specifically $1 million. Since they meet the net worth need, they qualify to be a recognized investor.

World-Class Passive Income For Accredited Investors

There are a couple of less typical certifications, such as managing a trust with even more than $5 million in properties. Under government safeties legislations, just those that are approved financiers may join specific protections offerings. These may consist of shares in personal positionings, structured items, and exclusive equity or bush funds, among others.

The regulatory authorities desire to be particular that individuals in these extremely risky and intricate financial investments can look after themselves and judge the threats in the lack of government protection. The accredited investor rules are developed to secure possible investors with restricted monetary expertise from high-risk endeavors and losses they may be unwell geared up to withstand.

Accredited financiers satisfy credentials and professional requirements to accessibility exclusive investment opportunities. Approved capitalists need to satisfy revenue and web worth demands, unlike non-accredited people, and can spend without limitations.

Comprehensive Exclusive Deals For Accredited Investors

Some vital modifications made in 2020 by the SEC include:. Consisting of the Collection 7 Collection 65, and Series 82 licenses or various other qualifications that reveal economic proficiency. This modification identifies that these entity kinds are usually made use of for making investments. This adjustment recognizes the competence that these staff members establish.

This change represent the effects of rising cost of living gradually. These modifications broaden the accredited financier pool by around 64 million Americans. This bigger gain access to provides a lot more chances for capitalists, yet also increases possible threats as much less financially innovative, investors can get involved. Organizations using exclusive offerings may profit from a bigger pool of possible capitalists.

These investment alternatives are special to accredited investors and establishments that certify as a recognized, per SEC guidelines. This gives recognized investors the chance to invest in arising firms at a stage prior to they think about going public.

Efficient Accredited Investor Crowdfunding Opportunities

They are considered as investments and are available just, to qualified customers. In addition to known firms, certified investors can pick to spend in start-ups and promising ventures. This offers them tax obligation returns and the possibility to go into at an earlier stage and potentially reap incentives if the company prospers.

For financiers open to the risks included, backing startups can lead to gains (accredited investor syndication deals). Several of today's technology companies such as Facebook, Uber and Airbnb stemmed as early-stage startups supported by certified angel financiers. Innovative investors have the opportunity to check out investment options that might generate more revenues than what public markets offer

Accredited Investor Real Estate Deals

Returns are not guaranteed, diversification and profile improvement alternatives are broadened for capitalists. By diversifying their portfolios via these broadened investment avenues recognized investors can enhance their methods and potentially attain superior lasting returns with appropriate threat monitoring. Seasoned capitalists often encounter investment alternatives that might not be conveniently readily available to the basic capitalist.

Investment alternatives and safety and securities used to accredited capitalists typically include greater risks. For instance, personal equity, equity capital and hedge funds commonly focus on purchasing possessions that carry danger yet can be liquidated quickly for the possibility of greater returns on those dangerous investments. Looking into prior to spending is vital these in circumstances.

Lock up durations stop financiers from withdrawing funds for even more months and years on end. Capitalists might have a hard time to accurately value exclusive possessions.

World-Class Venture Capital For Accredited Investors

This adjustment might extend certified investor condition to a variety of people. Upgrading the income and asset criteria for inflation to guarantee they mirror adjustments as time advances. The present limits have stayed fixed since 1982. Permitting partners in dedicated relationships to incorporate their sources for common eligibility as accredited financiers.

Allowing individuals with certain expert qualifications, such as Series 7 or CFA, to certify as recognized financiers. This would recognize financial class. Creating added demands such as proof of financial proficiency or effectively finishing a certified investor test. This might ensure capitalists understand the risks. Restricting or removing the key residence from the internet worth computation to decrease possibly filled with air assessments of wide range.

On the other hand, it could additionally result in knowledgeable investors presuming excessive risks that may not be appropriate for them. So, safeguards might be required. Existing accredited investors may deal with raised competitors for the very best financial investment chances if the pool grows. Business increasing funds may take advantage of an expanded certified capitalist base to draw from.

Renowned Accredited Investor Syndication Deals

Those who are presently thought about certified capitalists must stay updated on any modifications to the criteria and guidelines. Businesses looking for accredited capitalists need to remain alert regarding these updates to ensure they are attracting the best target market of investors.

Table of Contents

- – Strategic Exclusive Deals For Accredited Inves...

- – World-Class Passive Income For Accredited Inve...

- – Comprehensive Exclusive Deals For Accredited ...

- – Efficient Accredited Investor Crowdfunding Op...

- – Accredited Investor Real Estate Deals

- – World-Class Venture Capital For Accredited I...

- – Renowned Accredited Investor Syndication Deals

Latest Posts

Tax Lien Investing Risks

Otc Tax Liens

How To Invest In Tax Liens

More

Latest Posts

Tax Lien Investing Risks

Otc Tax Liens

How To Invest In Tax Liens